Establishing a Subsidiary: Steps, Differences, and Considerations

What is a subsidiary?

A subsidiary is a company which is partially or completely owned or controlled by another company. This other company is known as a parent or holding company.

There is a common misconception that holding companies need to be bigger than subsidiaries, however, subsidiaries can be larger than the parent company as the relationship is not controlled by the number of employees but by ownership of shares and voting power.

Subsidiaries are separate legal entities from the controlling company, meaning that both companies have separate debts and obligations, limiting shared liabilities between them.

Subsidiaries have independence from the companies holding them and they could even be separate individual brands. However, they are always influenced in the way they operate by the parent company.

Subsidiaries and parent companies don’t have to operate from the same country and they don’t even have to work in the same business sector, however, it’s key to consider that if the subsidiary is based in a different country, it must follow that country’s laws and regulations.

For a subsidiary to exist, the parent company has to:

Hold a majority of the voting rights in it; or

Be a member of it and have the right to appoint or remove a majority of its board of directors.

Example

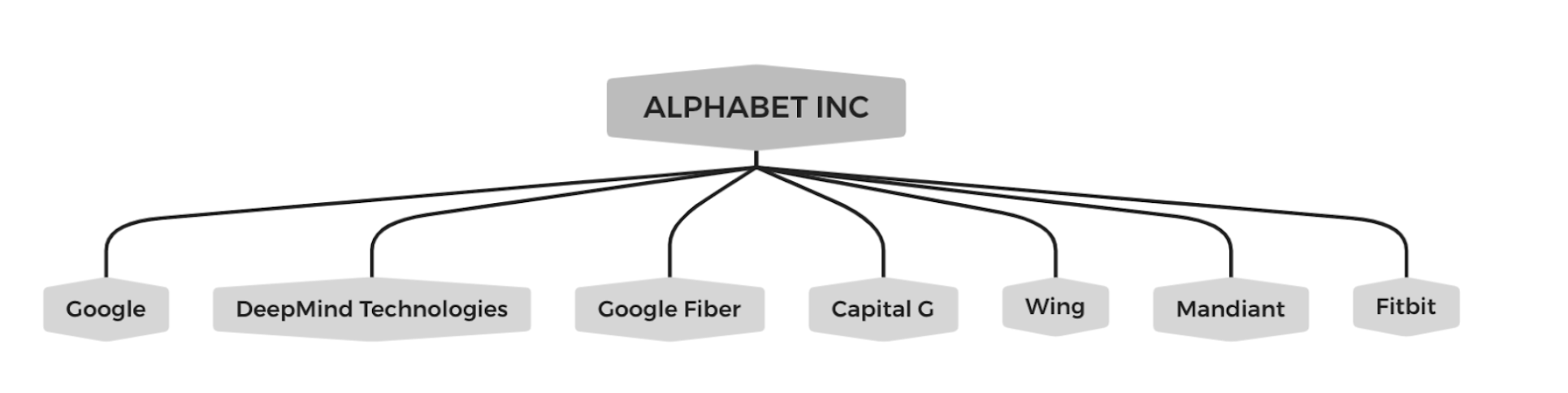

Alphabet Inc. is a company based in California which has no business operations of its own. However, it’s the parent of several other subsidiaries, like Google, DeepMind Technologies, Google Fiber, CapitalG and Wing. In the following diagram, we can observe the relationship between Alphabet Inc. and some of the over 160 subsidiaries that it owns.

Branch v Subsidiary

It’s essential to be able to distinguish between a branch and a subsidiary. The main difference between them is that all branches are part of the same company albeit having separate physical offices, allowing the business to provide services to a larger group of customers. On the other hand, subsidiaries are separate legal entities from the parent company, meaning they could be different brands with completely different operations.

When can a subsidiary be set up?

Subsidiaries can be formed when one company buys another, or is formed by the parent or holding company from scratch.

The requirements for a company to be considered a holding company are the following:

It needs to hold a majority interest in the subsidiary company.

It needs to control more than 50% of the subsidiary’s stock.

It needs to have a majority of voting rights.

How to set up a subsidiary?

If you are considering setting up a subsidiary, you might find yourself in one of the following situations:

UK company wanting to set up a subsidiary in the UK

As the subsidiary is a separate legal entity from the parent company, it must be correctly incorporated as a company itself.

The private limited company is the most common form of business structure used for a subsidiary in the UK. To set it up, the standard UK process to incorporate a business must be followed, which involves preparing a number of documents and sending them to the Registrar of Companies at Companies House. These documents include:

An application for registration as a company;

A memorandum of association for the company;

Possibly, articles of association for the company.

For more information on this, check out our article on How to Register a Company (Part 2) - Incorporation.

The last step is to wait until the process has been reviewed by Companies House and the Certificate of Incorporation has been issued.

2. UK company wanting to set up a subsidiary overseas.

Depending on the country, you will have to comply with local regulations and practices.

For more information on how to set up a subsidiary overseas, we have included the following links:

*Please note that the above links are included to merely provide an overview of the general requirements, and should not be relied upon definitively until independent legal advice has been sought.

3. An overseas company wanting to set up a subsidiary in the UK

The overseas parent company will own the shares of the subsidiary company set up in the UK, which will be a UK-limited company, governed under the law of England and Wales.

The overseas company will need to register as a company in the UK if they have any physical presence in the UK, such as an office, factory, etc. If they are trading as independent agents, distributors or employees who are visiting occasionally, registration won’t be necessary.

How to register an overseas company can be found here, and the first step to register as a foreign company in the UK is to submit the OS IN01 Form to Companies House with the £20 registration fee. How to complete this form can be found here.

What are the Advantages and Disadvantages of Subsidiaries?

Advantages

Autonomy: no need to reconcile financial statements between both companies;

Protection: as both companies are separate legal entities, they can be used as a liability shield against losses for the parent company;

Easy to establish;

Ability to synergize with other subsidiaries companies;

Possible commercial or regulatory advantages to having subsidiary;

Ability to reach a wider market.

Disadvantages

Laws differ between states and countries;

Complex financials (especially if a parent company owns multiple subsidiaries);

Legal costs of establishing it;

Subsidiary must file for Corporation Tax;

The UK subsidiary of a non-UK parent company will be subject to UK corporation tax on its worldwide profits and gains.

- Author: Irene Correro Garcia

- Author: Irene Correro Garcia

In partnership with:

DISCLAIMER

This article has been written by law students for the sole purpose of providing informative insight. The information in this article is intended for educational purposes only and does not constitute legal advice, nor should the information be used for the purpose of advising clients. You should seek independent legal advice before relying on any of the information provided in this article.

Sources

“Setting up a Subsidiary Company in the UK” (Paul BeareNovember 16, 2021) <https://www.paulbeare.com/uk-legal-structures/subsidiary/> accessed October 27, 2022

“What-Is-a-Subsidiary-Company” (Diligent Corporation) <https://www.diligent.com/insights/entity-management/what-is-a-subsidiary-company/#:~:text=A%20subsidiary%20and%20parent%20company,many%20cases%20are%20individual%20brands> accessed October 27, 2022

Willis T, “What's the Difference between a Branch and a Subsidiary? (2022 Update)” (LawpathMarch 19, 2021) <https://lawpath.com.au/blog/whats-the-difference-between-a-branch-and-a-subsidiary> accessed October 27, 2022

“UK Holding Company: Meaning, Structure & Examples - Osome Blog” (Osome UKAugust 1, 2022) <https://osome.com/uk/blog/how-to-set-up-a-holding-company-in-the-uk/> accessed October 27, 2022

“How Do You Set up a Subsidiary Company?” (Welcome to CROJanuary 13, 2022) <https://www.companyregistrations.co.uk/information-services/how-do-you-set-up-a-subsidiary-company/> accessed October 27, 2022